Struggling retirees and families are turning to ‘instant’ homes to circumvent the national construction crisis, as the latest building approvals drop 25 per cent below the 10-year average.

Australian Bureau of Statistics seasonally adjusted figures released Thursday show 2470 dwellings were approved in April across Queensland, 20 per cent below the monthly 40-year average and 25 per cent below the 10-year average.

The last time the state was above the monthly 40-year average was March 2023, thanks to a surge in unit approvals at the time. However, houses haven’t gone near their long-term average in almost two years. In April 1786, houses were granted building approval, most of which was by the private sector.

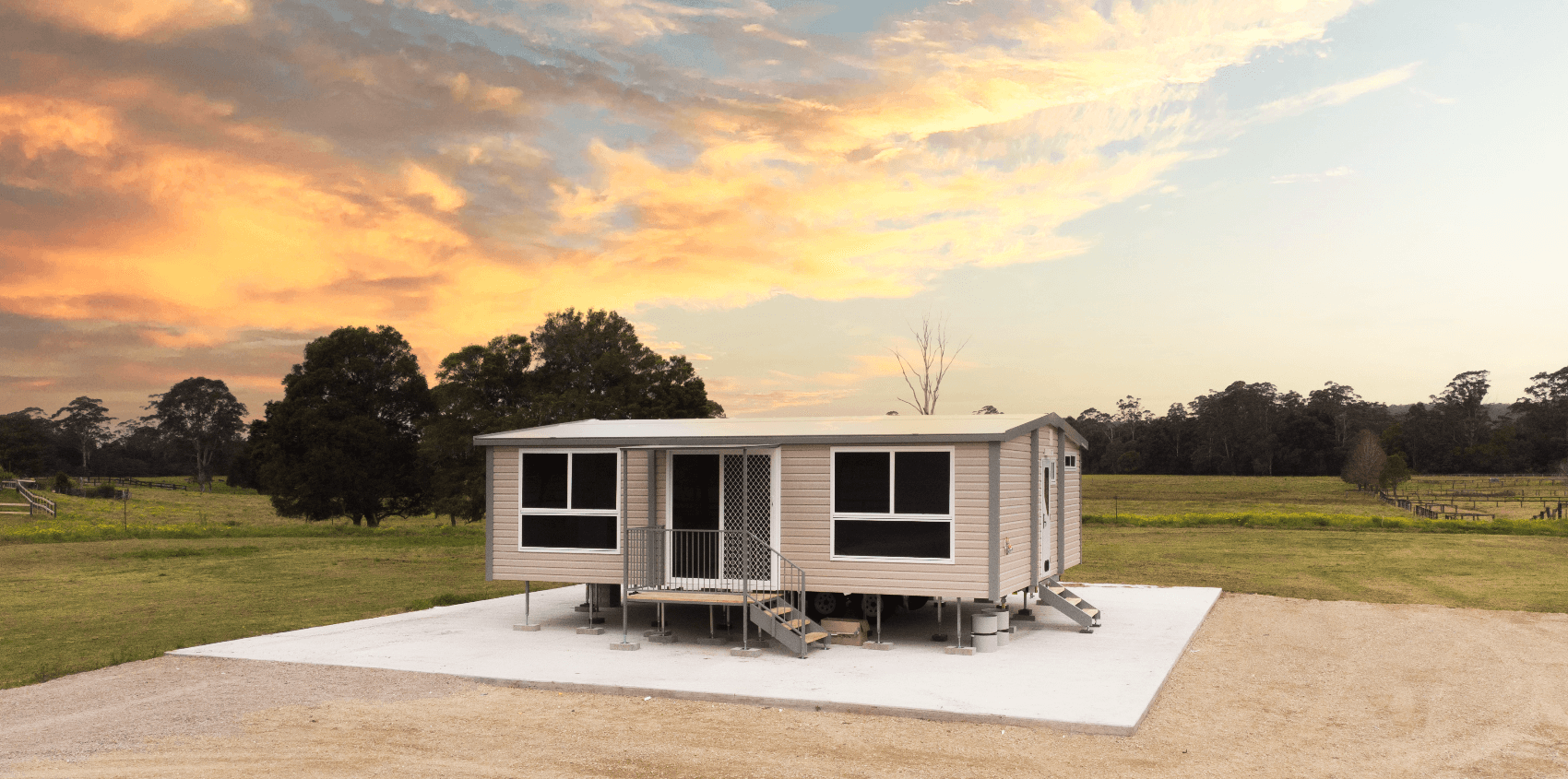

The crisis is seeing a surge in buyers turning to ‘instant’ movable housing solutions. Manufacturers are seeing record demand for homes requiring little on-the-ground construction effort, much of which is coming from older Aussies who can’t afford retirement villages.

VanHomes founder, Vito Russo, who runs one of Australia’s biggest manufacturers of relocatable granny flats, said they were flooded with requests and currently build 100 granny flats a week in one state alone.

“We are being inundated with enquiries from older people downsizing who want to move into easier, flexible and more affordable housing. For many, it makes better financial sense, because retirement homes are very expensive. According to the latest statistics, a home in a retirement village can cost anywhere on average from $400,000 to $700,000 depending on the location, and sometimes the cost can be more. Then on top of this, the ongoing fees can be in the hundreds to thousands each month. This kind of expense is now out of reach for most and as a result, retirees are looking at granny flats as the best option.”

Brisbane City Council changed the rules around granny flats a decade ago, not requiring approval as long as they met development criteria including that they be no more than 80sq m in size and no further than 20m from the main home.

NAB group chief economist Alan Oster said construction costs and rising interest rates were still seen as the biggest constraints on new housing developments. Given the results of the latest NAB Residential Property Index, which was released Thursday, prices are unlikely to slow down anytime soon.

“While price growth has slowed, the significant supply/demand imbalance in the housing market is likely to continue to support both prices and rents in the near term, despite the high level of interest rates and other pressures on households,” he said.

NAB’s Queensland’s state index saw a massive jump, going from +6 in the March quarter of 2023 to +70 for the same period this year, lodging it firmly in positive territory. Its survey of property professionals saw Queensland house price forecasts pushed higher – from an earlier expectation of 2.7pc to 3.4pc now, outpaced only by WA’s 5.2pc.

Master Builders Australia chief economist Shane Garrett said the April ABS data showed a concerning trend which would fall well short of National Housing Accord targets.

“The new National Housing Accord kicks off in less than five weeks’ time and envisages 240,000 new homes each year. However, the past 12 months have seen less than 163,500 new home building approvals across Australia.”

“Just 60,600 higher density dwellings were approved over the year to April. This is the lowest total for any 12-month period since September 2012, almost 12 years ago.”

He said “a 47 per cent increase in the volume of new home building output” was required to hit the housing accord target.

NAB expects the Reserve Bank to begin to ease interest rates from around November this year and take the cash rate to 3pc by the end of 2025.

This article originally appeared on news.com.au